About China’s countermeasures against U.S. reciprocal tariffs

On 4 April 2025, China’s government authorities announced a suite of countermeasures in response to U.S. imposition of 34% reciprocal tariffs on Chinese imports. The countermeasures include both the imposition of 34% tariffs on U.S. imports and some non-tariff measures (e.g. export control, trade suspensions).

Imposition of tariffs on U.S. imports

Effective 12:01 p.m. on 10 April 2025, China will impose a 34% tariff on all U.S. imports, in addition to existing tariffs. A grace period will apply to goods shipped before the effective date, allowing them to be imported without the additional tariff until 11:59 p.m. on 13 May 2025.

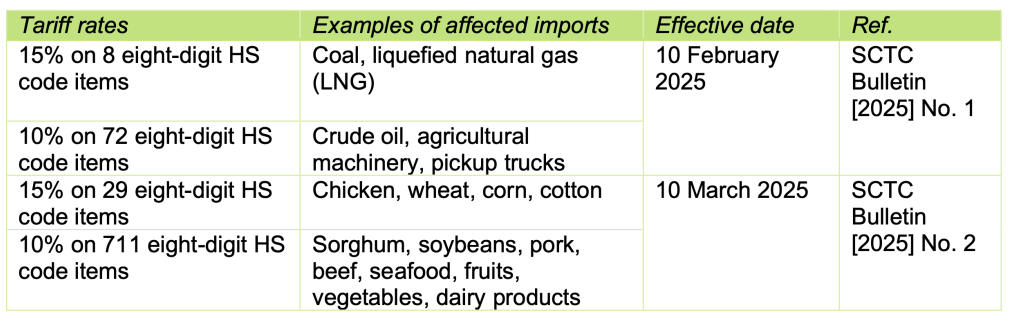

Before announcing the new tariffs, China’s State Council Tariff Commission (SCTC) had already issued two bulletins in February and March 2025, imposing additional tariffs on select U.S. imports, in response to the U.S. imposition of 10% (which was subsequently raised to 20%) additional tariffs on Chinese imports.

The tariff burden on U.S. imports is set to rise substantially. For instance, the tariff rate of U.S.-origin LNG (China HS code 2711.1100), previously at 25% (assuming no tariff exclusion), was raised to 40% on 10 February 2025. With the new 34% additional tariff, the rate could climb to 74%.

Unreliable Entity List

On 4 April 2025, China’s Ministry of Commerce (MOFCOM) announced the inclusion of 11 additional U.S. entities in its Unreliable Entity List (UEL). These entities are banned from engaging in China-related import/export activities and prohibited from making new investments in China.

Since 1 January 2025, a total of 44 U.S. entities have been added to the UEL. The list primarily comprises U.S. defense contractors and aerospace technology firms, and also includes entities from sectors such as biotech and consumer goods. One or more of the following measures have been imposed on the relevant U.S. entities in the list:

Ban on China-related import/export activities (including ban on exports of specific goods to China);

Prohibition from making new investment in China;

Entry bans for senior management into China; and

Cancellation or denial of work/residence permits in China for senior management.

Export control – controlled items

Effective from 4 April 2025, China has expanded its list of controlled items to include seven critical rare earth elements - samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium - along with their associated products. This follows the earlier addition of 25 rare metal items and associated technologies (including tungsten, tellurium, bismuth, molybdenum and indium) to the list, which took effect on 4 February 2025. Chinese businesses must obtain export permits from the MOFCOM before they export any controlled items.

Export control - Entity List

Effective from 4 April 2025, China has also expanded its Entity List to include 16 additional U.S. entities for export control purposes, bringing the total number of listed U.S. entities to 59 in 2025. Chinese exporters are generally prohibited from exporting dual-use items to these entities. In exceptional circumstances where exports are considered essential, enterprises may apply to the MOFCOM for special approval.

Trade investigations

On 4 April 2025, China’s MOFCOM announced the initiation of dual investigations concerning imports of medical CT tubes (China HS code: 9022.3000): an industry competitiveness investigation and an anti-dumping investigation. Notably, this marks China’s first industry competitiveness investigation in response to domestic industry request, aimed at evaluating import impacts on domestic businesses and their competitive position. The anti-dumping investigation specifically targets at imports of medical CT tubes originating from the U.S. and India. Both investigations are scheduled for completion by 4 April 2026, subject to potential extensions.

On 4 March 2025, the MOFCOM announced the initiation of China’s first anti-circumvention investigation into certain U.S.-origin optical fiber products. This investigation was initiated in response to complaints from a domestic fiber manufacturer alleging that relevant U.S. producers and exporters were circumventing existing antidumping duties, which currently range from 33.3% to 78.2%. The investigation is scheduled for completion within six months, subject to potential extensions.

Other measures

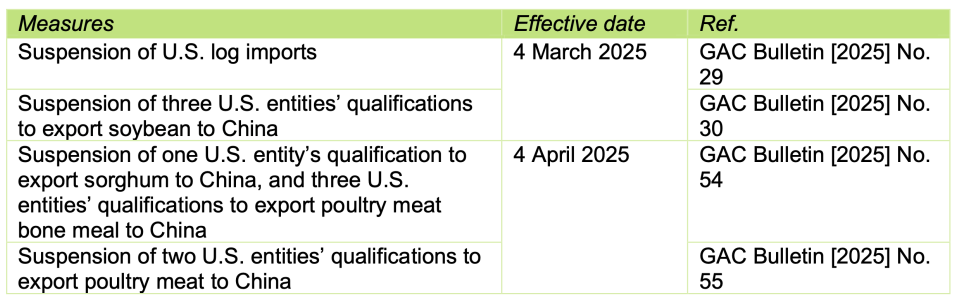

On 4 March and 4 April 2025, China’s General Administration of Customs (GAC) issued four bulletins suspending select U.S. imports and revoking qualifications for designated U.S. entities to export certain goods to China.

Recommendations

Authors:

Dolly Zhang

Tax Partner

+86 21 6141 1113

dozhang@deloittecn.com.cn

Candy Tang

Tax Partner

+86 21 6141 1081

catang@deloittecn.com.cn

Shelly Ma

Tax Director

+86 755 3353 8751

shelma@deloittecn.com.cn

Tomey Lin

Tax Director

+86 20 2831 1057

tomlin@deloittecn.com.cn

Iris Han

Tax Manager

+86 25 5791 5240

irihan@deloittecn.com.cn

Steven Zhu

Tax Manager

+86 23 8823 1992

stezhu@deloittecn.com.cn

For more information, please contact:

Indirect Tax

National Leader

Lily Li

Tax Partner

+86 21 6141 1099

lilyxcli@deloittecn.com.cn

Customs and Global Trade Services

National Leader

Dolly Zhang

Tax Partner

+86 21 6141 1113

dozhang@deloittecn.com.cn

Eastern China

Candy Tang

Tax Partner

+86 21 6141 1081

catang@deloittecn.com.cn

Northern China

Betty Mu

Tax director

+86 10 8512 5698

bemu@deloittecn.com.cn

Southern China

Janet Zhang

Tax Partner

+86 20 2831 1212

jazhang@deloittecn.com.cn

Western China

Frank Tang

Tax Partner

+86 23 8823 1208

ftang@deloittecn.com.cn

Disclaimer:

A 3rd party wanting to repost a Deloitte Wechat article should publish the content in its original form, without amendment. Any changes to content should be sent to Deloitte for review and approval before being released. The 3rd party is required to attach the information and disclaimer below to the reposted article:

This communication contains general information only and, while authorization for its publication has been granted, copyright is reserved by Deloitte Touche Tohmatsu, and none of Deloitte Touche Tohmatsu Limited, its member firms or their related entities (collectively, the "Deloitte Network") is, by means of this communication, rendering professional advice or services. No entity in the Deloitte network shall be responsible for any loss whatsoever sustained by any person who relies on this communication.

Please click "Read more" for more archived 【Deloitte Tax Newsflash】.

Reminder: Due to constraints associated with WeChat's interface, if you are unable to download the report after opening Deloitte's web page, please tap "Option" in the upper right hand corner and open it in a browser to download.

版权声明

本文仅作者转发或者创作,不代表旺旺头条立场。

如有侵权请联系站长删除

旺旺头条

旺旺头条

发表评论:

◎欢迎参与讨论,请在这里发表您的看法、交流您的观点。