A digest of China Customs Retaliatory Tariffs Guidance

In response to the US reciprocal tariffs on Chinese imports, China has enacted corresponding countermeasures, by imposing additional tariffs on US imports, effective from 12:01 p.m. on 10 April 2025. The additional tariff rate was initially set at 34%, subsequently increased to 84%, and further raised to 125%.

To enforce these additional tariffs, China’s General Administration of Customs (GAC) issued Bulletin 58 on 9 April 2025 to provide the implementation guidance.

This newsletter will address some of the most frequently asked questions regarding this new guidance as well as recommendations to the businesses potentially affected by these measures.

Will the additional tariffs apply to US import into Hong Kong SAR and Macau SAR?

The Hong Kong SAR and Macau SAR are separate customs territories and do not apply the additional tariffs imposed by China on US-origin goods. However, if US-origin goods are transported to China mainland via either Hong Kong SAR or Macau SAR, they will still be subject to the additional tariffs as the origin of the goods remains unchanged.

Are there any exclusions applicable to the additional tariffs?

The additional tariffs apply to all goods originating from the US that are imported into China. So far, there is no formal announcement of exclusion. In contrast, the US "reciprocal tariff" policy establishes certain exemption criteria and maintains an official list of exempted goods. Based on previous customs enforcement practices, cross-border e-commerce (CBEC) retail imports may potentially be exempted.

What will be the tariff rates on US-origin goods imported into China?

The additional tariffs are imposed on top of the current applicable most-favored-nation (MFN) rate or interim duty rate, as well as any previously imposed additional tariffs. For example, liquefied natural gas (LNG) originating from the US (HS Code 2711.1100) now has a cumulative tariff rate of 165% (i.e. MFN rate of 0% + 25% additional tariff since 1 June 2019 + 15% additional tariff since 10 February 2025 + 125% additional tariff from this round).

What are the critical deadlines for "goods in-transit" to avoid the additional tariffs this time?

US origin goods imported under the "goods in-transit" regime must meet specific timing requirements to avoid the additional tariffs:

For non-bonded processing goods, the transport vehicle must have departed from the place of departure before 12:01 p.m. on 10 April 2025, and the goods must be declared for import before 24:00 on 13 May 2025.

For goods imported through bonded zones or other special customs supervision areas, the same timing requirements apply as above.

For royalty payments that should be included into the dutiable value of "in-transit goods" but were paid and declared after 13 May 2025, it is still unclear whether such payments qualify for exclusion from the additional tariff. Importers are advised to consult local customs authorities to ensure compliance.

What is the impact to existing tariff reductions and exemptions regime?

China’s existing tariff reduction and exemption policies remain unchanged. However, the additional tariffs imposed in this round are not eligible for any reductions or exemptions.

What are the key changes to bonded processing and bonded logistics regime?

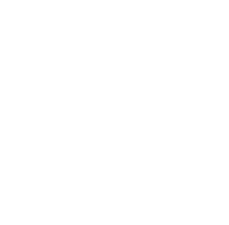

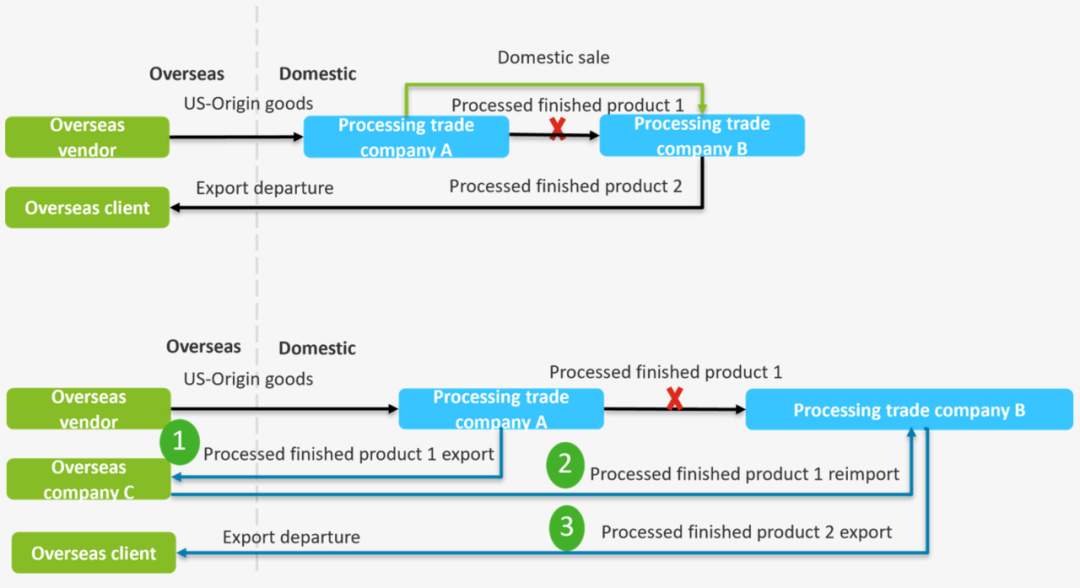

Starting from 12:01 p.m. on 10 April 2025, bonded processed products containing US-origin materials are no longer permitted to circulate under bonded status, whether within or outside customs special supervision areas. This restriction applies to the "factory transfer" or "U turn" model (illustrated below). This change may significantly impact companies' bonded operation management.

Recommendations for businesses affected by the additional tariffs

Strengthen origin management

Correctly determine the origin of goods, especially for products involving US-origin materials;

Establish robust procedures for supplier origin verification and maintain relevant documentation.

Utilize grace period for "in-transit goods"

Promptly submit import declarations for goods in transit within the grace period;

Ensure compliance with procedural requirements outlined in Bulletin 58 and prepare necessary documentation.

Revisit bonded business arrangements as appropriate

For businesses relying on US-origin materials, reassess bonded processing strategies and explore alternative logistics arrangements or export/import cycles to mitigate the impact of the new restrictions.

Enhance compliance and documentation of bonded processing business

Maintain dedicated account books or remarks for US-origin materials and their finished products;

Consider applying for advance origin rulings from customs authorities if necessary.

Review and update trade contracts

Incorporate clauses in the contract addressing potential policy changes, tariff adjustments, and regional trade conflicts;

Clearly define responsibility for tariff costs and potential penalties in the event of non-compliance to avoid disputes.

Authors:

Dolly Zhang

Partner

+86 21 6141 1113

dozhang@deloittecn.com.cn

Roger Chen

Partner

+86 21 2316 6922

rogechen@deloittecn.com.cn

Tomey Lin

Director

+86 20 2831 1057

tomlin@deloittecn.com.cn

Iris Han

Manager

+86 25 5791 5240

irihan@deloittecn.com.cn

For more information, please contact:

Indirect Tax

National Leader

Lily Li

Partner

+86 21 6141 1099

lilyxcli@deloittecn.com.cn

Customs and Global Trade Services

National Leader

Dolly Zhang

Partner

+86 21 6141 1113

dozhang@deloittecn.com.cn

Northern China

Betty Mu

Director

+86 10 8512 5698

bemu@deloittecn.com.cn

Eastern China

Candy Tang

Partner

+86 21 6141 1081

catang@deloittecn.com.cn

Southern China

Janet Zhang

Partner

+86 20 2831 1212

jazhang@deloittecn.com.cn

Western China

Frank Tang

Partner

+86 23 8823 1208

ftang@deloittecn.com.cn

如需阅读中文版,请点击链接:

Disclaimer:

A 3rd party wanting to repost a Deloitte Wechat article should publish the content in its original form, without amendment. Any changes to content should be sent to Deloitte for review and approval before being released. The 3rd party is required to attach the information and disclaimer below to the reposted article:

This communication contains general information only and, while authorization for its publication has been granted, copyright is reserved by Deloitte Touche Tohmatsu, and none of Deloitte Touche Tohmatsu Limited, its member firms or their related entities (collectively, the "Deloitte Network") is, by means of this communication, rendering professional advice or services. No entity in the Deloitte network shall be responsible for any loss whatsoever sustained by any person who relies on this communication.

Please click "Read more" for more archived Tax Analysis.

Reminder: Due to constraints associated with WeChat's interface, if you are unable to download the report after opening Deloitte's web page, please tap "Option" in the upper right hand corner and open it in a browser to download.

版权声明

本文仅作者转发或者创作,不代表旺旺头条立场。

如有侵权请联系站长删除

旺旺头条

旺旺头条

发表评论:

◎欢迎参与讨论,请在这里发表您的看法、交流您的观点。